When it comes to filing taxes, not all taxpayers require the same level of service. Depending on your financial situation and the complexity of your tax return, you may need more or less assistance.

With a variety of tax return services available, there is sure to be an option that fits your needs.

Types of Tax Return Services

Self-Service Tax Preparation: Self-service tax preparation is ideal for those who have a relatively simple financial profile and are comfortable completing their own taxes online.

Online programs such as TurboTax offer step-by-step guidance and will check for errors before filing your return electronically with the IRS. Tax return services in Melbourne are a great way to maximize your financial returns and ease the stress of the yearly tax season.

Full-Service Tax Preparation: If you have a complex financial profile or simply don’t have time to prepare and file your own taxes, full-service tax preparation may be for you.

A professional accountant will review all sources of income, identify potential deductions, complete all necessary forms and ensure that everything is filed accurately with the IRS on time.

Virtual Tax Preparation: Virtual tax preparation bridges the gap between self-service and full-service options by providing individualized assistance throughout the entire process without having to meet face-to-face in person with an accountant or other professional.

You can upload documents securely online which will then be reviewed by one of their expert staff

Benefits of Professional Tax Return Services

Tax season can be a stressful time for many people, but it doesn’t have to be. Hiring a professional tax return service can help ease the stress of filing taxes and can even offer some financial benefits.

Here are just a few of the benefits of using a professional tax return service:

- Increased Accuracy – Professional tax return services are highly trained in understanding and interpreting the complexities of the IRS code, which means that they are better able to ensure accuracy when filing your taxes. This increased accuracy will help ensure that you don’t receive any unexpected surprises or penalties from the IRS due to errors on your return.

- Maximizing Your Tax Refund – Professional tax preparers have access to software and information that allows them to maximize deductions and credits that may apply to you, ensuring that you get back every penny possible from your refund this year.

- Up-to-Date Information – The laws regarding taxes change regularly; having an experienced professional on your side who is familiar with all of these changes will help guarantee that all applicable regulations are met when filing your taxes this year.

4. Time Savings – Filing taxes can often be a time-consuming process; hiring a professional service will save you time.

Cost Considerations for Professional Tax Return Services

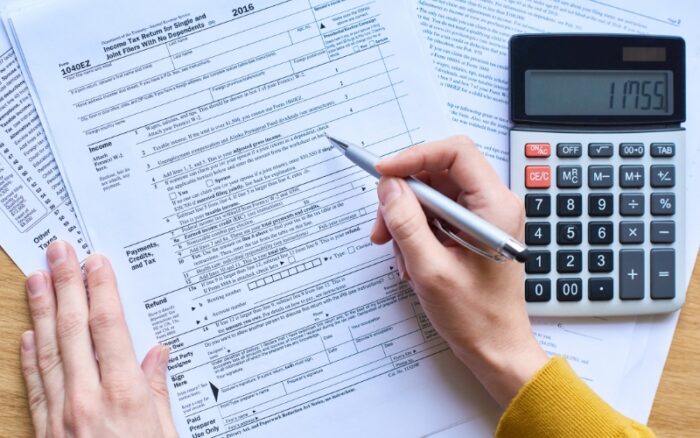

Tax season can be an incredibly trying time for many individuals. Between the complex forms, deadlines, and calculations required to properly file a return, it’s no surprise that many people turn to professional tax return services for assistance.

But before you enlist the help of a professional, it’s important to consider all the potential costs associated with their services.

The most obvious cost associated with professional tax preparation is the fee charged by your service provider. Depending on your individual circumstances and needs, these fees can range from an hourly rate of $50-$300 or more.

Some providers may also charge additional fees on top of their base rate depending on how complex your taxes are or if they need to file multiple returns (e.g., state and federal). It’s important to discuss all possible costs upfront so there are no surprises when you receive your bill at the end of tax season.

Another cost consideration is whether any specialized software or tools are needed in order to prepare your return accurately and efficiently. Many professionals use software programs like TurboTax or H&R Block which can add significantly to their overhead costs as well as yours if you have to purchase them yourself in order for them to do their job correctly.

Choosing a Professional Tax Return Service Provider

As April 15th quickly approaches, many individuals and businesses are searching for a professional tax return service provider. Choosing the right tax preparer is an important decision that should not be taken lightly. Whether you’re filing your taxes online or in person, here are some tips to help you make the right choice:

- Research Credentials- Before choosing a tax service provider, take the time to research their credentials and background. Check to see if they have any certifications from reputable organizations such as the IRS or AICPA (American Institute of Certified Public Accountants). This will ensure that your taxes are being handled by someone who is knowledgeable and experienced in filing returns correctly and efficiently.

- Ask About Experience- It’s also important to find out how long the tax return service provider has been in business and what type of clients they typically work with (individuals vs businesses). By having this information ahead of time, you can be sure that your taxes will be prepared accurately based on years of experience handling similar scenarios.

- Compare Prices- Many people get caught up in finding the cheapest price when it comes to filing their taxes; however, this isn’t always a wise move as lower prices.

Conclusion

Overall, tax return services provide a valuable service that can help taxpayers navigate the complex and often difficult process of filing taxes accurately and on time.

Tax return services can also provide advice and guidance to taxpayers who need assistance in understanding their rights and duties when it comes to filing taxes.

Using a tax return service can be beneficial for those who do not have the time or knowledge to file their own taxes accurately, as it saves time and reduces the risk of making mistakes.