In the United States, about 40 to 50% of couples get divorced. In 2024, 782,038 couples divorced, meaning the divorce rate currently stands at 2.9 per every 1000 couples.

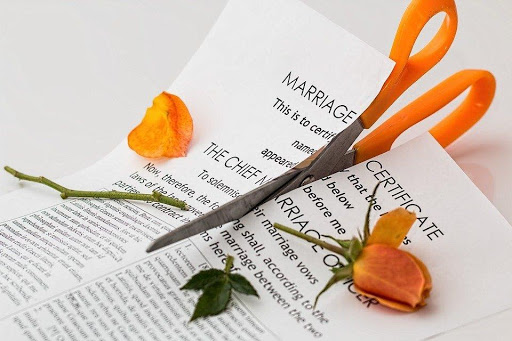

Going through a divorce is not only emotionally draining, but it’s also financially exhausting. The biggest problem that divorced couples have to deal with is the division of assets. This depends on the length of the marriage and many other factors.

These logistical and financial decisions are made even more complicated when considering the student debt of one or both parties.

Today, we’ll discuss what happens to student loans if a couple decides to get divorced.

What is marital debt?

Marital debt includes all the student loans that you or your spouse took out during your marriage. Suppose you borrowed money for your education before you got married. In that case, your student loans are your sole responsibility, and your partner is not legally obliged to contribute to the repayment of said debt.

However, cases of marital debt get complicated if the court has to divide the loan; moreover, each state has its own rules about how to divide debt in a divorce.

Two ways of dividing marital debt

A court can allocate debt in a divorce in two ways; the first is to consider the debt communal property. In this case, all marital debts are divided equally, or 50/50 between both parties. The second model that courts may follow is equitable distribution. Equitable distribution is a more common model that considers the evidence and determines how to split debt equitably.

Equitable distribution is not a 50/50 split; the process aims to adjust debt in a manner that’s fair to both parties. This decision is made by considering when certain loans were taken, for what purpose, and the other spouse’s contributions.

Factors to consider in an equitable distribution

The court considers other factors in the division of debts as well, such as the assets and liabilities owned by each party and the duration of the marriage. If a partner was previously married, the court will take their existing financial obligations into account. Lastly, the court will consider the direct or indirect contributions each spouse made during the marriage.

For example, suppose one spouse was going to school, and the other spouse took care of the household and sacrificed their own career/education goals to support their partner. In that case, this could be considered an indirect contribution. In this case, the spouse who took out a loan to pay for their education will be given most of the debt, while the spouse who contributed indirectly will be assigned a smaller share.

Whether your partner is aware of a certain loan or not is also an important consideration. For example, if you took out a student loan during your marriage using a joint credit card and your spouse had no knowledge of it, it’s your sole responsibility to pay off the debt you took out on that card.

Do you have to pay your partner’s student loans if they are considered marital debt?

If your spouse earned a professional degree during your marriage by taking out student loans, this degree is considered marital property in some US states.

In common-law states, you are not liable to pay your spouse’s debt. The exceptions are if you consigned the loan with your partner or if the loan amount was spent on joint expenses.

Common-law states include Utah, Alabama, Colorado, Montana, Kansas, Pennsylvania, Oklahoma, Iowa, and Rhode Island.

If you live in a community property state, all loans taken out after you get married are considered joint property. As such, you are legally obliged to pay off your spouse’s debts, and if your spouse misses a payment, dies, or becomes insolvent, the creditors can come after you to pay their loans.

Community property states include Arizona, Washington, California, Idaho, Louisiana, Nevada, New Mexico, Texas, and Wisconsin. The state of Alaska has an opt-in option where you can declare your debts marital property if both you and your spouse agree.

If a degree is a marital property in the state where you and your spouse live, the loan taken out for this degree is joint property, and the amount of the loan is then shared between the two parties.

In some cases, the courts order the higher-earning party to help the lower-earning party pay off their student loans after the divorce, which is termed financial support.

Secondly, if the student loan you or your spouse took out was used for tuition and to pay for joint living expenses, then the amount of the student loan is divided between both parties as both benefited from the student loan.

In an equitable distribution model, the court will also consider the income of each party. If one party received an education based on student loans, which increased their income, they are more likely to be assigned a larger portion of the student debt.

On the other hand, if one party set aside their own educational or professional goals to support their spouse, the court will assign them a tiny percentage of the overall student debt.

In some cases, the courts may ask the degree-holder to compensate their spouse for their help or contribution when they were receiving their education.

What if your spouse dies while still having student loans?

If your spouse had federal loans, these are automatically considered void, and they are not passed on to the surviving spouse. The government may ask you to pay taxes on the loan amount that was forgiven or discharged.

Private loans depend on the lender; it is their choice whether to discharge a loan in case of death or to make you liable for repaying your spouse’s loan. In community property states, you will be responsible for paying your spouse’s loans after their death. You will also be held responsible if you were a cosigner of that loan.

About the Author

The author is a financial expert on student loans at ELFI (Education Loan Finance) — a national private lending company. He has helped several college graduates and parents strategically manage their finances to secure degrees from high-quality educational institutes across the United States.