Are you a business owner or manager concerned about regulatory compliance? Are you aware of the risks and consequences that non-compliance can bring to your organization? In today’s ever-evolving business landscape, it is critical to ensure that employees are trained in risk-based supervision to avoid costly penalties and reputational damage. Join us as we delve into the importance of RBS training in ensuring compliance for your business. Don’t wait until it’s too late – let’s get started!

Regulatory compliance involves keeping up-to-date with ever-changing laws and regulations at the local, regional, and international levels. The consequences of non-compliance range from financial penalties, and damage to a company’s reputation, to potential business closure in extreme cases. Hence, understanding the criticality of compliance is fundamental to business continuity and growth.

The Role of Risk-Based Supervision Training in Compliance

To help businesses navigate the labyrinth of regulatory compliance, RBS is a modern approach gaining traction worldwide. This approach allows regulatory bodies to prioritize resources toward higher-risk areas, thus improving efficiency and effectiveness.

Online RBS Training plays a vital part in this process. It equips professionals with the knowledge and skills necessary to understand and manage risks inherent to their businesses. RBS education provides a robust foundation for recognizing, evaluating, and controlling potential threats before they escalate into significant issues.

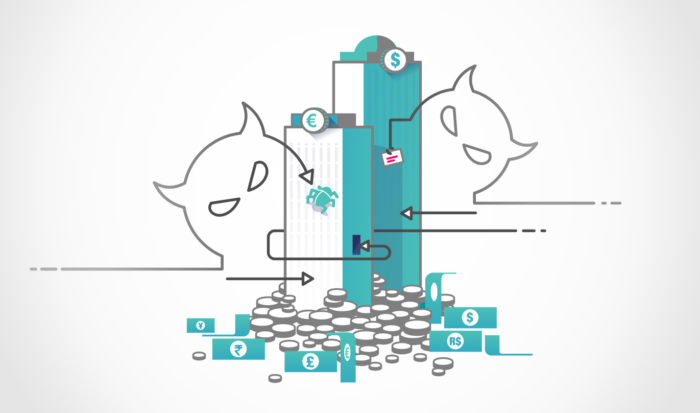

Importance of RBS in Mitigating Financial and Operational Threats

Risks are part and parcel of the business landscape. However, if not managed effectively, they can wreak havoc on a company’s financial stability and operational efficiency. RBS training can help organizations mitigate these problems.

For instance, financial threats can manifest in various forms such as credit, liquidity, market, and operational risks. Proper RBS education enables businesses to identify these problems and devise appropriate control mechanisms. Additionally, it can help companies understand and navigate the complexities of regulatory requirements, preventing potential compliance breaches that can lead to hefty fines and reputational damage.

Key Elements of an Effective RBS Program

An effective RBS training program should be comprehensive, covering all relevant areas of risk for an organization. Some key elements include understanding the regulatory landscape, identifying and assessing risks, implementing effective risk management strategies, and monitoring and reporting threats.

The education should also incorporate real-world case studies to illustrate potential risk scenarios and how to handle them. Simulations and interactive sessions can also be beneficial, encouraging participants to actively engage in risk assessment and management.

Regulatory Frameworks and Guidelines

Various regulatory bodies provide frameworks and guidelines for RBS. For instance, the Basel Committee on Banking Supervision (BCBS) offers comprehensive guidelines on risk-based supervision for financial institutions. Similarly, the International Organization of Securities Commissions (IOSCO) has set out principles for securities regulation, which include risk-based supervision.

Organizations need to stay abreast of these guidelines and ensure their RBS training programs align with them. Regular updates to education programs are necessary to keep up with changing regulatory landscapes.

Building a Compliance Culture through RBS Training

Compliance is not merely a responsibility for risk or compliance departments; it needs to be ingrained in an organization’s culture. RBS training can play a significant role in cultivating a culture of compliance. Instilling a risk-aware mindset encourages employees at all levels to take ownership of their roles in managing threats.

Education sessions can promote transparent communication about threats, enhancing collective understanding and cooperation in risk management. Furthermore, by aligning RBS training with an organization’s vision and values, businesses can further foster a culture of compliance.

Benefits of RBS Training: Enhancing Organizational Efficiency and Reputation

Investing in RBS training reaps significant benefits. Firstly, it equips employees with the knowledge and skills to manage risks proactively, enhancing overall organizational efficiency. Secondly, it can save businesses from the adverse impacts of non-compliance, such as fines, legal repercussions, and reputational damage.

By demonstrating a commitment to compliance, companies can boost their reputation among stakeholders, including customers, partners, regulators, and the public. This, in turn, can lead to enhanced trust, customer loyalty, and business opportunities.

Implementing RBS Training: Challenges and Best Practices

Implementing RBS training is not without challenges. These could include the complexity of regulations, lack of understanding about risks, resource constraints, and resistance to change. To overcome these obstacles, organizations can adopt several best practices.

Firstly, businesses should understand their specific risk landscape and tailor the training accordingly. They should also ensure the course is interactive and engaging, fostering active participation. Moreover, continuous reinforcement and refresher sessions can help consolidate learning and keep the training relevant.

Measuring the Effectiveness of RBS Training Programs

Ensuring the effectiveness of Risk-Based Supervision (RBS) training programs is pivotal for businesses. Accurate evaluation aids in identifying strengths and areas for improvement, ensuring that the training programs are indeed equipping the workforce with the right skills and knowledge. To do this, organizations can utilize multiple evaluation metrics, including participant feedback, which provides first-hand insights into the perceived value of the training.

Knowledge tests are another significant tool, allowing organizations to measure learning outcomes objectively. Participants’ performance on these tests can be a direct indicator of whether the training content has been understood and absorbed. Furthermore, performance indicators related to risk management — such as the frequency of risk incidents or the efficacy of risk mitigation actions — can provide a practical perspective on the training’s impact.

Continuous Professional Development in RBS Training

RBS training should not be a one-time event. Given the ever-evolving regulatory and risk landscapes, continuous professional development is crucial. This could involve periodic refresher courses, advanced training for specific roles, or workshops on emerging risk trends.

Continuous training not only helps maintain compliance but also enables employees to grow professionally. It promotes a culture of learning, motivating employees to stay informed and equipped to handle potential risks.

Conclusion

In today’s business landscape, RBS training is essential to ensure compliance and protect against the risk of non-compliance. Companies must take the necessary steps to educate their employees on the importance of staying compliant and up-to-date with all relevant regulations in order to remain competitive and profitable. Investing in regular RBS training sessions can equip businesses with a comprehensive understanding of regulatory requirements, allowing them to reduce costs, improve efficiency, and minimize legal risks for years to come.