Staying ahead of legal practice demands the mastery of nuances and seamless orchestration of administrative processes. Imagine a scenario where your law firm’s financial management is as precise and strategic as your courtroom arguments. The key lies in harnessing technology that caters specifically to the intricacies of legal accounting. Sadly, many law firms don’t know when to invest in legal accounting management software.

In the quest for efficiency and excellence, challenges may arise, especially from the amalgamation of legal services and financial intricacies. The meticulous task of balancing client accounts, managing retainers, and allocating expenses can be a daunting one, diverting valuable time and resources from your core legal pursuits.

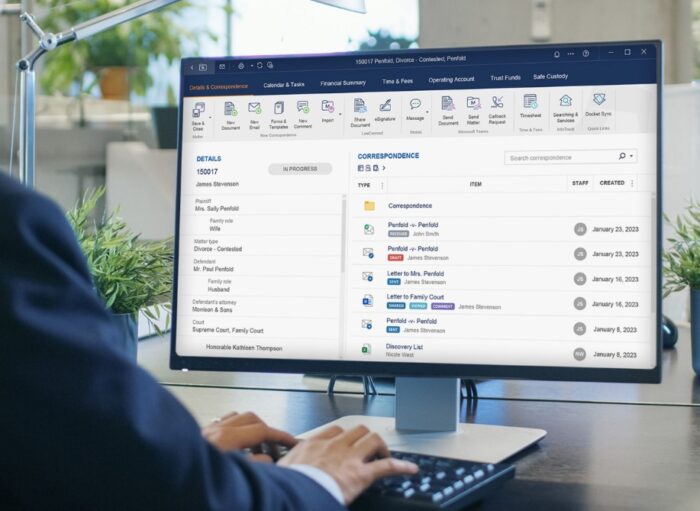

This is where cutting-edge legal accounting management software comes in. It can become an indispensable ally in your journey toward optimized financial control. And the best thing is that you can find this software on sites such as Uptime Practice.

In the following paragraphs, you’ll learn about the pivotal considerations that should shape your decision-making process.

The Role Of Legal Accounting Management Software

Legal accounting management systems act as strategic partners, redefining how you maintain financial control. They’re designed to address challenges unique to the legal sector.

Beyond streamlining accounting processes, they act as guardians of accuracy. If used correctly, they can transform your financial management from an administrative task into a core element of strategic decision-making.

How To Know When To Invest In Legal Accounting Management Software

Increased Caseload

As your client base grows, so do the complexities of managing their accounts. The surge in caseloads and corresponding financial transactions can strain conventional accounting methods, increasing the likelihood of errors. If you find yourself overwhelmed by the volume of financial data, it’s a clear sign that your firm is primed for a more advanced solution.

Expanding Client Base

A growing roster of clients often means dealing with a diverse range of financial arrangements—varying retainer agreements, payment schedules, and expense structures. Legal accounting software thrives on complexity, making it the ideal companion when your client base expands. It will ensure accurate financial representation for each unique scenario your company encounters.

Accuracy Issues

Have inaccuracies in financial records ever sparked concern or disputes in your company? Inaccurate financial data can mar client relationships and even lead to legal challenges. When you find yourself investing excessive time in reconciliations and corrections, it’s a clear indication that automated accuracy checks offered by accounting software can greatly benefit your practice.

Struggling With Regulatory Compliance

The legal field is intertwined with intricate regulations that govern financial practices. Staying compliant is not just a legal obligation but a matter of maintaining your firm’s reputation. Legal accounting management software often comes equipped with features that aid in compliance tracking and reporting, a critical advantage in an environment where adherence to regulations is paramount.

Desire For Real-Time Insights

In the current legal world, making timely decisions is crucial. The ability to access real-time financial data can give you with insights that guide your decisions, enable you to allocate resources efficiently and make informed strategic moves. If the desire for instant financial visibility resonates with you, it’s a strong indicator that you should invest in accounting software that aligns your firm’s objectives.

Resource Drain From Manual Processes

Legal professionals are at their best when they’re focused on legal strategy and not drowning in spreadsheets. Manual financial management consumes valuable time and energy that could be better spent on client interactions and case development. When you find yourself wishing for more time to dedicate to your core competencies, it’s time to explore automation through legal accounting software.

Preparation For Scaling

Is your firm on the cusp of expansion? Scaling a law practice involves more than just adding attorneys—it requires scalable infrastructure, including financial systems. Legal accounting management software lays the groundwork for streamlined financial operations. As your firm grows, it will enable you to handle increased caseloads without compromising quality.

8 Benefits Of Legal Accounting Management Software

1. Precision

In the world of law, precision matters, especially when it comes to finances. Legal accounting management systems leave no room for human error. They ensure every financial transaction is meticulously recorded and accurately attributed. This heightened accuracy can cultivate trust among clients and fortify your firm’s financial foundation.

2. Time-Efficiency

Mundane tasks that once consumed hours now take mere moments. Legal accounting software automates the laborious aspects of financial management, liberating your time and resources. With automation handling routine transactions and calculations, you can invest more time in refining your legal strategy and strengthening client relationships.

3. Enhanced Financial Visibility

The software’s intuitive dashboards grant you an instantaneous view of your firm’s financial landscape. These insights can help you make informed decisions swiftly, and align your strategies with real-time financial data. Such clarity facilitates effective resource allocation, leading to optimal efficiency.

4. Strategic Resource Allocation

Allocating resources—both financial and human—requires finesse. Legal accounting software can expedite the allocation process and guide your decisions. Through its analytical tools, it will let you identify areas where financial resources need to be reallocated for maximum impact.

5. Client-Centric Services

The hallmark of any thriving law firm is its ability to serve clients exceptionally. With the burden of manual financial management lifted you can shift your focus back to what truly matters—providing top-tier legal services. The software fosters an environment where legal professionals are empowered to nurture client relationships and focus on case development.

6. Regulatory Compliance

Navigating the labyrinth of legal financial regulations can be perplexing. Thankfully, legal accounting management software can be your compliance companion. It will ensure that your firm adheres to every financial regulation, minimizing the risk of non-compliance and safeguarding your firm’s reputation.

7. Scalability

As your firm evolves, so do your financial needs. Legal accounting software will scale with you, adapting to the changes in your caseload and client base. Whether your firm expands or pivots, the software will be a reliable partner, always evolving to meet your growing financial demands.

8. Empowerment For Growth

The legal field is dynamic, with opportunities for growth around every corner. Armed with advanced financial management tools, your firm will be positioned to seize these opportunities with confidence. Legal management systems will offer you the financial infrastructure needed to support your expansion plans seamlessly.

Considerations For Implementation

The transition to legal accounting management software requires careful navigation. Anticipate potential challenges or resistance within your firm during the adoption phase. Address concerns by highlighting the advantages that the software brings to the table. Offer training opportunities to ensure a seamless integration process, minimizing disruption to existing workflows. Remember, a well-executed implementation strategy paves the way for a successful digital transformation.

Wrapping Up

The integration of legal accounting management software is not a matter of if, but when. The signs are clear—increased caseloads, expanding client bases, and accuracy concerns—all herald the readiness for the investment. As the legal world continues to evolve, the strategic decision to embrace legal accounting management software can be a transformative choice.