Cryptocurrency has become an increasingly popular investment option in recent years, with the rise of digital currencies such as Bitcoin, Ethereum, and Litecoin. However, with the explosive growth of the industry, scams and fraudulent schemes have also become more prevalent, targeting unsuspecting investors who are new to the market.

As a beginner trader, it’s essential to be aware of these risks and take steps to protect your investments.

In this article, we’ll provide 5 tips to help you spot and avoid cryptocurrency scams, including how to do your due diligence, secure your private keys, and diversify your portfolio.

By following these tips, you can reduce your risk and make more informed investment decisions in the exciting world of cryptocurrency.

1. Understanding Common Cryptocurrency Scams ─ Phishing, Ponzi Schemes, and Fake ICOs

The rise of cryptocurrency has opened up a new world of opportunities for investors, but it has also created new risks. As with any new investment market, there are always individuals who seek to take advantage of those who are not yet familiar with the nuances of the market. Cryptocurrency scams come in many different forms, but some of the most common types include phishing scams, Ponzi schemes, and fake initial coin offerings (ICOs).

Phishing scams are designed to trick investors into providing their private keys or other sensitive information by posing as a legitimate cryptocurrency exchange or wallet provider. One of the best ways to avoid falling for this type of scam is to always double-check the URL of any website before entering sensitive information. Another strategy is to use a reputable wallet provider or exchange, which offers advanced security features like two-factor authentication and cold storage to keep your funds safe.

Ponzi schemes, on the other hand, are investment scams that promise high returns with little or no risk. These scams rely on a continuous stream of new investors to pay off the returns of earlier investors. Eventually, the scheme collapses when there are no longer enough new investors to sustain the payouts. Avoiding these types of scams is relatively simple: if an investment opportunity sounds too good to be true, it probably is.

Fake ICOs are another common type of cryptocurrency scam. These scams involve creating fake websites and marketing materials for a new cryptocurrency project, often with promises of massive returns. Investors are encouraged to buy tokens in the ICO, but the project is never actually developed. Instead, the scammers disappear with the funds raised. One way to avoid this type of scam is to research the project and its team carefully before investing. Look for reputable sources of information, which provide insights and analysis on the latest trends in the cryptocurrency market.

2. Researching the Project and Developers ─ Check the Team’s Background, Whitepapers, and Roadmaps

Before investing in any cryptocurrency project, it’s essential to research the project and its developers carefully. One of the best ways to do this is to read the project’s whitepaper, which should provide detailed information about the project’s goals, technology, and team. Look for projects that have a clear vision and a well-defined roadmap for achieving their goals. You can also check the project’s website for information about the team and their backgrounds.

If you’re not sure where to start with your research, consider consulting with trusted advisors like financial professionals or experienced cryptocurrency traders. These individuals can provide valuable insights and help you navigate the complexities of the cryptocurrency market. You can also use online resources like bitql.cloud to stay up-to-date on the latest trends and analyses in the market.

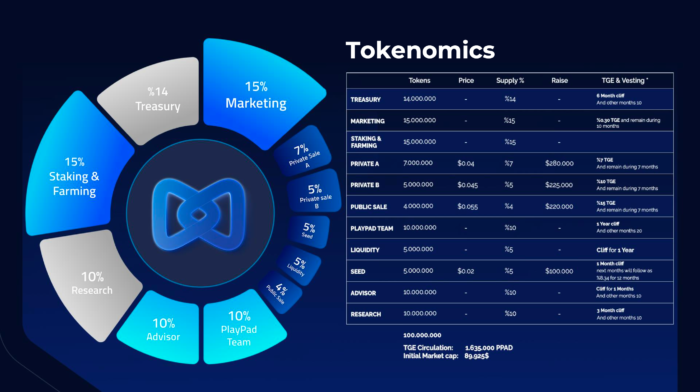

3. Examining the Tokenomics ─ Look at the Token’s Total Supply, Distribution, and Utility

When it comes to investing in cryptocurrency, one of the most important factors to consider is the tokenomics of the project. Tokenomics refers to the economics of the token, including its total supply, distribution, and utility. By examining these factors, you can gain a better understanding of the long-term value proposition of the project and make more informed investment decisions.

Total supply is one of the most critical factors to consider when evaluating a cryptocurrency project. In general, projects with a limited total supply are more likely to appreciate in value over time. This is because a limited supply creates scarcity, which can drive up demand and price. Conversely, projects with unlimited or uncapped supplies may struggle to maintain value over time.

Distribution is another important factor to consider when examining the tokenomics of a cryptocurrency project. Ideally, the token should be distributed fairly and widely, with no single individual or group controlling a significant portion of the supply. This can help ensure that the project remains decentralized and resistant to manipulation.

Finally, it’s essential to consider the utility of the token when evaluating a cryptocurrency project. Look for projects with a clear use case for their token, as this can help drive demand and value over time. Some tokens are used as a means of payment, while others are used to access special features or services within the project’s ecosystem. Whatever the use case, it’s important to understand how the token fits into the overall vision of the project.

4. Avoiding Unrealistic Promises and Guarantees ─ Don’t Fall for Get-Rich-Quick Schemes

One of the most significant risks of investing in cryptocurrency is falling for unrealistic promises and guarantees. Unfortunately, there are many individuals and projects in the market that make bold claims about their ability to generate massive returns with little or no risk. These types of claims are almost always too good to be true, and investors who fall for them can end up losing their entire investment.

To avoid falling for get-rich-quick schemes, it’s essential to approach cryptocurrency investing with a healthy dose of skepticism. Be wary of any project that promises guaranteed returns or makes unrealistic claims about its technology or potential. Instead, focus on investing in projects with a clear use case, a strong team, and a well-defined roadmap for achieving their goals.

5. Keeping Your Private Keys Safe ─ Use Secure Wallets and Two-Factor Authentication

One of the most critical aspects of cryptocurrency investing is keeping your private keys safe. Private keys are used to access and control your cryptocurrency holdings, and if they fall into the wrong hands, you could lose your entire investment. That’s why it’s essential to take steps to secure your private keys, such as using secure wallets and two-factor authentication.

A wallet is a piece of software that allows you to store and manage your cryptocurrency holdings. There are many different types of wallets available, including hardware wallets, software wallets, and paper wallets. Each type of wallet has its pros and cons, but in general, hardware wallets are considered the most secure option.

Two-factor authentication is another important tool for securing your cryptocurrency holdings. This is a process that requires you to enter a second form of identification, such as a code sent to your phone or an authentication app, in addition to your password. This can help prevent unauthorized access to your accounts and keep your funds safe.

All in All

In conclusion, the world of cryptocurrency can be an exciting and lucrative place to invest, but it’s important to approach it with caution and diligence. As a beginner trader, it’s essential to educate yourself on the risks and common scams associated with this emerging asset class. By doing so, you can avoid falling victim to fraudulent schemes and make more informed investment decisions.